Manufactured Homes

How is a Manufactured Home taxed?

Manufactured Homes are Taxed as either Real or Personal property

- Real Estate Manufactured Home - Any manufactured home which is located on land owned by the owner of the manufactured home shall be listed and assessed as real property in the county in which it is located. The owner may also apply for homestead exemption.

- Personal Property Manufactured Home - Any manufactured home located on land not owned by the owner of the manufactured home shall be assessed as personal property in the county in which it is located.

How do we determine the market value of your manufactured home?

In Caddo County, market value is based on a market driven cost approach. In determining a final market value, the following adjustments must be considered:

- Quality of Construction

- Square footage

- Types of amenities

- Physical condition at time of physical inspection

All value adjustments are derived from current market information gathered at the time of the sale from the following sources:

- Sales between dealers and individuals

- Sales between individual owners to individual buyers

To move a manufactured home or transfer title:

Senate Bill 1114 effective June 10, 1998, requires proof of paid current calendar year ad valorem tax (OTC form 936). This form can only be completed in the County Assessors office in the county where the manufactured home is located.

The following section is a quick reference guide which will summarize most of the transactions involved in moving or changing title to a manufactured home:

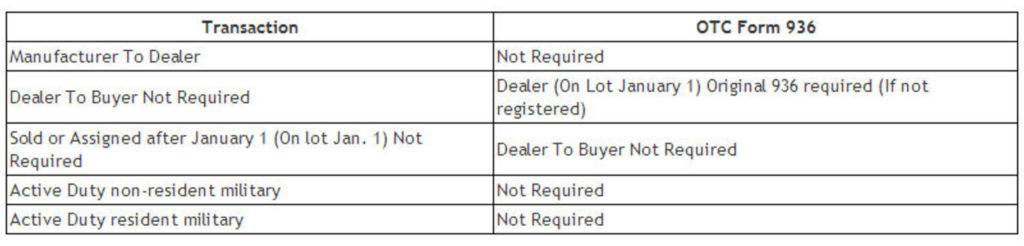

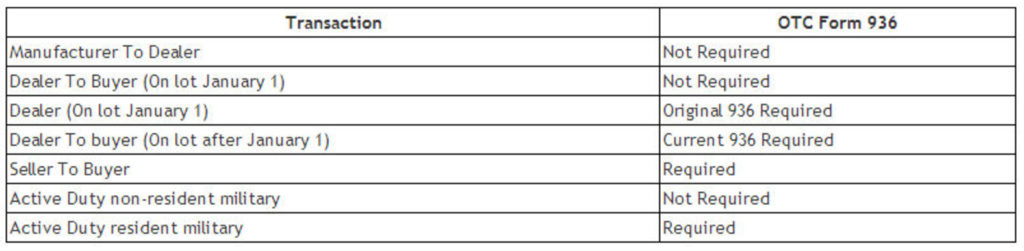

Moving a new or used manufactured home (see table below)

Transferring title on a new or used manufactured home(see table below)

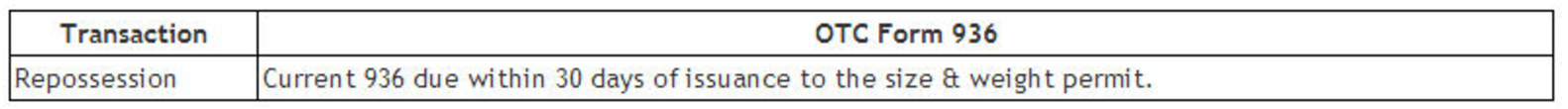

Repossession(see table below)

Take me back to Information.